Webnote 7: Growth of open years *

| End of year | Number of Open Years of Account |

| 1980 | 34 |

| 1981 | 34 |

| 1982 | 45 |

| 1983 | 36 |

| 1984 | 86 |

| 1985 | 107 |

| 1986 | 99 |

| 1987 | 122 |

| 1988 | 115 |

| 1989 | 92 |

| 1990 | 97 |

| 1991 | 162 |

| 1992 | 317 |

| 1993 | 478 |

| 1994 | 584 |

Source: Lloyd’s

Webnote 8: Neville Russell letter, February 1982 *

Mr Blake of Neville Russell wrote on behalf of his firm and five other firms of panel auditors on 24 February 1982, seeking guidance from Lloyd’s on the treatment of reserves for asbestosis. The main part of the letter, which was cited in the Jaffray judgment, was as follows:

“A substantial proportion of our syndicate clients have losses, or potential losses, arising from asbestosis and related diseases.

It appears that although, in respect of direct insurance of the main carriers and reinsurance of American insurers, syndicates have received some notification of outstanding claims, they are unable to quantify their final liability with a reasonable degree of accuracy for the following reasons:

(i) You have informed us that there have been approximately 15,000 individual claimants. Total exposure to the problem appears to be considerably in excess of this figure.

(ii) The courts have not yet finally decided on whether the exposure or manifestation basis is applicable.

(iii) The losses are being apportioned over carriers on an “industry” basis. If one of the carriers has losses in excess of its insurance cover (as seems likely) then it could go bankrupt. It appears that its share of the industry loss could be apportioned over the remaining companies.

(iv) Most syndicates are not very certain of their reinsurance recoveries.

(v) Most syndicates will incur losses on their own writings of reinsurance business. Very little of this has been advised so far.

The audit instructions (Clause 3) required that if there are any factors which may affect the adequacy of the reserves, then the auditor must report to the Committee and obtain their instructions before issuing his Syndicate Solvency Report.

We consider that the impossibility of determining the liability in respect of asbestosis falls into this category and we accordingly ask for your instructions in this respect”.

Webnote 9: Market Bulletin, March 1982 *

This bulletin was signed by Murray Lawrence, Deputy Chairman, on 18 March 1982 and sent to all underwriters, managing agents and syndicate auditors, after being discussed and approved by the Committee of Lloyd’s. This bulletin and the minutes of the Audit Committee meeting that preceded it, and other related material, were all cited in the Jaffray judgment. This is available at http://www.bailii.org/cgi-bin/markup.cgi?doc=/ew/cases/EWCA/Civ/2002/1101.html

‘Asbestos – Lloyd’s audit at 31 December 1981

Potential claims arising in connection with asbestosis represent a major problem for insurers and reinsurers. It is therefore all the more important that the reserves created in the Lloyd’s audit at the 31 December 1981, fairly reflect the current and foreseeable liabilities of all syndicates.

I should stress that the responsibility for the creation of adequate reserves rests with managing agents who will need to liaise closely with their auditors. Clearly, individual circumstances will vary, but it is felt that the following broad guidelines may be helpful to Underwriters, Managing Agents and Auditors in agreeing equitable reserves as at 31 December 1981, and ensuring, so far as possible, a reasonably consistent approach to this problem.

- Reserves for asbestosis liabilities should be separately identified and disclosed to Auditors. This applies for both the closing and opening years.

- Substantial information has been built up in the London office regarding direct business and all underwriters should check the information available to ensure that their own records are as complete as possible. This information should also be made available to the syndicate auditors.

- It is in the area of reinsurance writings that the information available may be least complete. Nevertheless, the Committee believes that some information is now available within the Market and Underwriters and Managing Agents should discuss with their auditors the steps they have taken to quantify and reserve for losses which may arise on an Excess of Loss or Pro Rata basis as a reinsurance of American or other insurers. In this connection, Underwriters should attempt to identify reinsurance on whom asbestosis claims are likely to fall and to seek their opinion as to the basis on which they intend to submit claims on their reinsurance contracts together with the reserves which they are carrying at the present time and an estimate of possible future liabilities.

- The Committee is aware of the legal argument whether liability arises on the basis of “exposure” or “manifestation”. It is not, however, for the Committee to express an opinion as to which is correct. For the purpose of reserves at 31st of December 1981, Managing Agents are strongly advised to carry a reserve which is the higher of the alternatives.

- An IBNR “loading” should be carried for those claims not specifically advised but which could come to light in the years ahead. The decision regarding the appropriate IBNR percentage is a matter for the Agent and his Auditor to resolve dependent upon the circumstances of each case. It would be inappropriate for the Committee to lay down a minimum loading but, it appears that this loading should be substantial to reflect unreported cases, on the direct account and incomplete information on the reinsurance account. Credit may of course, be taken in respect of reinsurance recoveries, but agents should verify, so far as possible, that reinsurers have been identified and have agreed to accept claims on the basis submitted. In the event that there are any disagreements with reinsurers these should be discussed with Auditors. (The normal guidelines regarding the admissibility of reinsurance recoveries obviously will apply.)

- A syndicate which has written a run-off or stop loss in respect of an Asbestosis account which has been signed into an open year, should advise the details to its Auditors and where appropriate, the open year reserves should be increased.

- A syndicate underwriting London Market Excess of Loss business should make particular and comprehensive efforts to ascertain the extent of its possible liability going beyond those claims which have been advised at 31 December 1981, and these should be fully disclosed to and discussed with Syndicate Auditors. The same requirement should apply to specialist Personal Stop Loss Syndicates.

- Where the reserve for asbestosis represented a material proportion of the total reserves of the syndicate, Agents should consider whether or not to leave the account open. It is the Agent’s responsibility to ensure that the reserves provided for Asbestosis are sufficient to meet the Syndicate’s liabilities regardless of whether the account is closed or left open.

- Managing and Members Agents are strongly advised to inform their Names of their involvement with asbestosis claims and the manner in which their syndicates current and potential liabilities have been covered.

I would urge you to discuss the contents of this letter with your Auditor before deciding what further action, if any, is necessary for you to take.

If you should have any enquiries with regard to this matter would you please contact Mr M Bowmer (extension 3299) or Mr K E Randall (extension 3124).

This letter has been sent to all Underwriting Agents and Active Underwriters, with copies for information to all Panel Auditors.’

Webnote 10:Early scandals and litigation *

These matters are described more fully in Godfrey Hodgson’s book, Lloyd’s of London: A Reputation at Risk.

The Wilcox Case

In 1954, a dishonest underwriter, Alec Wilcox, persuaded a doubtful accountant to sign his audit certificate. This was investigated; Gibb[1] records ‘the remarkable fact was established that a fraudulent underwriter had for years been conspiring with a fraudulent chartered accountant. That two birds, each so rare in his own surroundings, should chance to come together was extraordinary. The odds against such a thing happening must be very long indeed. But happen it did, and the issue of the union was a conspiracy which managed temporarily to defeat the Lloyd’s audit.’ The Committee took the view that the Names should be protected, as they could not have known what was going on. It was also decided that, despite the adverse publicity it would generate, Lloyd’s would seek the prosecution of Wilcox and his accomplice in the courts. Both received heavy sentences.

The Sasse Case

A market bail-out over the Sasse affair in the late 1970s was the first time that Names started to litigate. By then the membership included many without close ties of family or friendship to inhibit them. The losses of the Sasse syndicate began to mount, due to bad underwriting, which included dubious American and Canadian property insurance. The Committee suspended the wealthy and popular underwriter responsible, Tim Sasse. A young underwriter, Stephen Merrett, whose father, Roy, had been a respected Lloyd’s figure, was asked by the Chairman to take over the troubled syndicate. He reluctantly agreed and began to investigate. More and more problems were uncovered. The losses reached £40,000 per Name and were still climbing.

By 1979, the losses of one member had crossed a threshold of tolerance. Outwardly Paddy Davies seemed like many an English gentleman. But he was an international businessman with Brazilian citizenship. He looked for the best lawyer and alighted on Leon Boshoff, a litigation partner described by a top barrister as ‘six foot four of South African granite.’ Boshoff advised that there was a case, but Davies would need to get others to help fund the action. Paddy Davies formed a ‘Davies Group’ of a dozen Names. Lloyd’s needed to secure an audit certificate for the Sasse syndicate, in order to pass the overall annual solvency test. This meant that members were called upon to pay in cash.

By August Paddy Davies’ losses had reached £258,000, with three weeks to pay. A reinsurance had been placed in the Lloyd’s market to prevent any further deterioration, but losses on this scale were still too much for Davies. His lawyers wrote to the Chairman saying that they were the result of bad conduct and involved breaches of Lloyd’s own rules. Davies met the Chairman, hoping for a standstill while the matter was properly investigated. He received a firm ‘no.’ He used the telephone outside the Chairman’s office to tell Boshoff that the gloves were off.

Lloyd’s was shocked by the challenge. It responded by suing the Names for payment by 30 September. Boshoff sought an injunction restraining Lloyd’s from collecting the money. By now 27 Names had joined the action. The name at the top of the case known as Acland and others vs Lloyd’s was an elderly Brigadier who had fought in Abyssinia. He said with some relish that it was forty years since he’d last gone to war.

The judge, Sir John Donaldson, was concerned at the damage being done to Lloyd’s reputation. He adjourned the case and persuaded the Committee to drop the deadline, tide Names over with a loan, and the parties to agree to arbitration. After several months this effort was mired; Boshoff returned to Court. Under the pressures of discovery of documents and seven months in Court, Lloyd’s finally came round to agreeing a settlement. It was evident that Lloyd’s had itself become implicated by its handling of the Sasse irregularities. The Names paid £6 million – £80,000 each on average – the Society paid £16 million. Many concluded that relationships between Lloyd’s and its members would never be the same again. The Sasse affair was one of the events that led to the setting up of an enquiry into the future of self-regulation at Lloyd’s, chaired by Sir Henry Fisher, mentioned in the book.

Savonita

The Savonita was bound for the US from Italy with a cargo of 2,700 cars, mostly Fiats. A fire broke out after 8 hours, the ship returned to port, where 301 Fiat cars were unloaded. A dispute ensued about the reinsurance claim for the total loss of these vehicles, many of which, according to Hodgson, were spotted ‘happily driving around Italy.’ He devotes 25 pages to the intricacies of this complex story which he describes as ‘an exceptionally bitter, if intrinsically trivial, market row that led to sharply unfriendly scrutiny of Lloyd’s in the press and Parliament.’ The furore generated by clumsy handling of this issue, along with the Sasse case mentioned above, were the principal sagas leading to the appointment of the Fisher Working Party, described in Appendix 3 of the book, that proposed for Lloyd’s a new Council and a new Act of Parliament.

Peter Cameron Webb (PCW)

Another scandal involved the syndicate run by Peter Cameron Webb, (PCW.) Soon after the passage of the new Act in 1982, fraud was discovered during investigations that followed the US take-over of a broker, Alexander Howden. Peter Dixon was chairman of both the PCW and WMD managing agencies. The syndicates of each had placed reinsurance with related companies, benefitting Dixon and Cameron-Webb. A detailed description of the fraud can be found in Godfrey Hodgson’s Lloyd’s of London: A Reputation at Risk, pages 344-353.

At first the complaining Names were brushed aside. Statutory immunity gave Lloyd’s fresh confidence to deny it had a role to compensate those who had suffered. The Chairman, Peter Miller, who was himself a member of the PCW syndicate, said “we share the outrage of the members upon whom a theft of £40 million was perpetrated.” Nevertheless, the number of Names affected was “relatively small” at less than 400. He declared that the Council could not provide some sort of financial lifeboat and thus depart from the principle that each individual had to pay his losses. The threat of litigation did not go away; the first settlement was made in 1984, using £40m that had been recovered. Further legal action was held in check by constant negotiations as the losses mounted.

In 1985, Miller anticipated strong concern over PCW losses and announced a new substitute agency, (AUA3) to be chaired by Sir Ian Morrow, a highly respected Scottish Chartered Accountant and company trouble-shooter, to run off the syndicate and negotiate with Lloyd’s on behalf of its members. When challenged by John Donner, a members’ agent with Names on PCW, Miller held the line that the PCW losses could not be taken on by the membership as a whole – or ‘mutualised.’

When questioned closely at the 1985 Lloyd’s AGM by a Name whose losses were over half a million pounds, Miller, who was trained as a lawyer, reiterated the prevailing philosophy: ‘The hard fact remains that the incompetent or even wrongdoing agent is still the agent of the Name. The Council will seek to ensure competence and prevent wrongdoing – but the consequences can only be faced by the individual Name for his individual share. That remains the policy of the Council.’ In the years that followed, this question of ‘mutualising’ further losses became a central issue for debate at Lloyd’s. It surfaced over Outhwaite; it dominated discussion throughout 1991 and 1992. Those with egregious losses wanted to share them with everyone else; most of the others thought the principle that each member wrote only for himself was sacred.

In 1986 Miller believed compromise was possible. He said that the PCW Names must ‘respond to losses justly and properly established, however they may have arisen. At the same time, it must be the wish of all of us to see a fair and early settlement of this matter. The alternative would be five or more years of litigation here and perhaps in the United States, which would be expensive, of no assistance to our good name, and might well cast doubts on our ability to deal with our own problems.’

He was reminded of the strength of feeling about PCW. Julian Tennant, an underwriter, whose wife was a PCW member, told him: “your remarks under the circumstances were somewhat smug and self satisfactory. I believe that the reputation of this country, of the City of London, has been greatly damaged by what has occurred in Lloyd’s recently, and over the PCW syndicate.” Members were “perfectly happy to pay up every penny we possess if the QE2 goes down,” but this was different. “There are a lot of Names who feel very strongly they will fight to the very end because it is a matter of principle. This sad event has not been handled in the way those of us believe English gentleman would handle a situation such as this.” Another member, a physician, asked whether there were any more rotten apples in the barrel, pointing out that unless people like him had confidence, they would be unwilling to continue as members.

Eventually, a settlement was offered and accepted in 1987. Names were asked to put in £40 million; brokers and accountants contributed £55 million. Lloyd’s put in £40 million, but agreed that the central fund would support any further deterioration. Once again, the presence of fraud was the key feature that made it acceptable for the Society as a whole to shoulder Names’ losses. Miller called it “one of the most shameful episodes in the long history of Lloyd’s.” He sought to draw a line under the PCW affair, saying “ladies and gentlemen, the long nightmare is over. The offer made by Lloyd’s has been declared unconditional with over 95% of the Names involved accepting.” He said that it had been unique because it involved not only genuine underwriting losses, but also the theft of monies by the managing agents by improper use of reinsurance. He assured members that the modern system of regulation now in place would prevent a recurrence.

Lloyd’s imposed a record fine on Peter Dixon, former head of PCW Underwriting Agencies, and expelled him,describing him as ”a clever, dishonest, greedy and unscrupulous individual.” Lloyd’s added that Mr. Dixon’s shady practices over a period of more than a decade ending in 1982 were ”a complete negation” of the principles of honesty and integrity that were the foundation of the institution.

Five co-conspirators in the PCW affair were also disciplined by Lloyd’s, but it was unable to mount disciplinary proceedings against Peter Cameron Webb who had resigned quickly. Lloyd’s made repeated representations to the British prosecuting authorities for them to seek the extradition of Cameron Webb from the United States, so that he could be brought to justice in Britain. These requests were not acted upon.

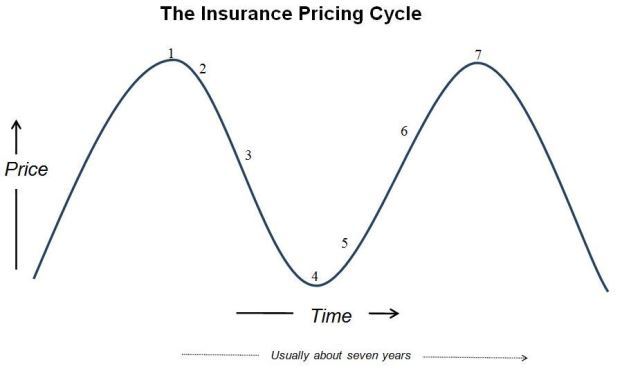

Webnote 11: The Insurance Pricing Cycle *

1. Pricing is at its peak. Underwriting is profitable. Investors are earning windfalls. Capital piles into the market to chase these returns.

2. Prices begin to decline as brokers negotiate better deals based on the profitability of the previous year, and as increased competition from new entrants drives prices to more rational levels.

3. More capital chasing the same insurance business forces prices to a median level. Profitability is achievable for the best underwriters.

4. Continued price competition drives prices to their nadir. No one can make money. Insurance buyers enjoy low prices.

5. Weak companies fail, usually in the wake of catastrophe losses. Others leave the market following unsustainable results. Underwriters insist on higher premiums, and pricing begins to climb.

6. Pricing continues its ascent in a supply-constrained market. Everyone is making money.

7. Pricing is at its peak. Underwriting is profitable. Investors are earning windfalls. Capital piles into the market to chase these returns, and the cycle is repeated.

Source: this schematic was developed by Dr Adrian Leonard, a Cambridge academic.

Webnote 12: Neill Recommendations on: *

- Standard Underwriting Agency Agreement: Deficit Clause

- Professional Qualifications

The Neill report contained 70 recommendations, all of which were acted upon by Lloyd’s, several within a matter of days. A full account of this is well beyond the scope of this book. The following two matters are mentioned only briefly in the book. The lack of a deficit clause, which had been recommended by earlier reports on Lloyd’s, was widely seen by Names as symptomatic of unfairness in the relations between Names and their agents. The absence of a requirement for professional qualifications was also seen as significant in view of abuses that reflected the widespread ignorance of the law of agency.

The Neill Committee observed that because Names placed their entire fortunes at risk, the agreement between them and their agents was “of critical importance.” Both the Cromer and Fisher reports had recommended a standard form of agreement. Neill thought it had taken too long for a standard agency agreement to be prescribed: it was due to take effect from 1 January 1987, but without the mandatory deficit clause recommended by both Cromer and now by Neill (recommendation 25) who found the arguments against it unconvincing.

Deficit Clause

Despite its technical-sounding title, the deficit clause was a simple idea: a Name’s losses would be offset against profits before calculating the agent’s profit commission. Its absence was seen as unfair by many Names. It was normal practice at Lloyd’s for agents to take profit commission on each syndicate and each year, regardless of losses on other syndicates or in recent years. After Neill’s report was received, the Council set up a working party, chaired by Edward Walker-Arnott, a nominated member of Council. Brian Pomeroy, also a nominated member and previously a member of the Neill Committee, was also a member of this group which was asked to consider Neill recommendations 17-28.

The group proposed that a ‘horizontal’ deficit clause should be available from all members’ agents. This would mean that before calculating profit commission, a members’ agent would have to deduct losses made on some syndicates from profits made on others, only taking his profit commission on the net result. This would align his results with those of the Name for which he was working.

A ‘vertical’ deficit clause was also developed to apply to managing agents: it would mean that if a syndicate had made a loss in the previous year, this would be deducted from profits in the current year, with profit commission only taken on the net result. Some Names wanted this to extend back for a longer period. A consultation process ensued in April 1988, whereby Names were asked whether they favoured the imposition of these clauses, with no alternative, or simply an obligation on members’ and managing agents to offer deficit clauses.

A consultation document proposed that the horizontal deficit clause should be a compulsory feature of the standard agency agreement; the vertical clause might be optional, for only one year. At an AGM, Tom Benyon queried the presence of five agents on the working party examining the mandatory deficit clause. He argued that the agents had double conflicts of interest, not only their own, but as senior officers of listed companies, they had shareholders to look after as well as Names.

Following the consultation exercise and much debate, the then Deputy Chairman, David Coleridge, informed the market in November 1988 of the Council’s decisions. From 1990 onwards, the horizontal deficit clause was to be mandatory for members’ agents, and a one-year vertical deficit clause was also to be a required feature of standard agreements between members and managing agents.

Professional Qualifications

Neill considered the level of competence of underwriters and directors at Lloyd’s. The Committee concluded that professional qualifications should be required for the “considerable responsibilities in conducting the insurance business on behalf of Names”, observing that much trouble had been taken to introduce a substantial volume of rules surrounding the conduct of business. Neill also observed that a knowledge of the law of agency was essential to the proper conduct of business.

Neill recommended that within a reasonably short timescale, mandatory examinations should be introduced for all those intending to become active underwriters. The precise contents of the syllabus would be for Lloyd’s to work out, but the qualification should include insurance law, Lloyd’s own regulatory requirements and relevant accounting and management techniques for the conduct of insurance business. The report said “we have in mind a far more rigorous examination than anything so far devised by Lloyd’s and one closer in scope and depth to those of professional bodies.”

After much debate, in May 1989 the Council of Lloyd’s passed a byelaw requiring every underwriter to pass examinations for the Lloyd’s Market Certificate from 1 January 1992 onwards. Exemptions were granted to those who were already in post as active underwriters. The examinations were to be administered, set and marked by the Chartered Insurance Institute. The first examinations for the LMC were held in 1990, with papers in English Law (with special reference to the law of agency), principles and practice of insurance and Lloyd’s regulatory requirements.

Over the next few years the requirement for the LMC was extended to the directors of agencies. The scope of the examinations was extended to be the equivalent of Associate level of the Chartered Institute of Insurance (ACII).

[1] Lloyd’s of London: A Study in Individualism D E W Gibb 1957