- Webnote 1: Composition of Lloyd’s membership 1981-1994

- Webnote 2: Early version (1978) of Lloyd’s verification form

- Webnote 3: Summary of Membership: The Issues, first published in 1987

- Webnote 4: Liability Insurance – uncertainty about the cost of claims

- Webnote 5: Evolution of Lloyd’s Governance

- Webnote 6: Lloyd’s architects

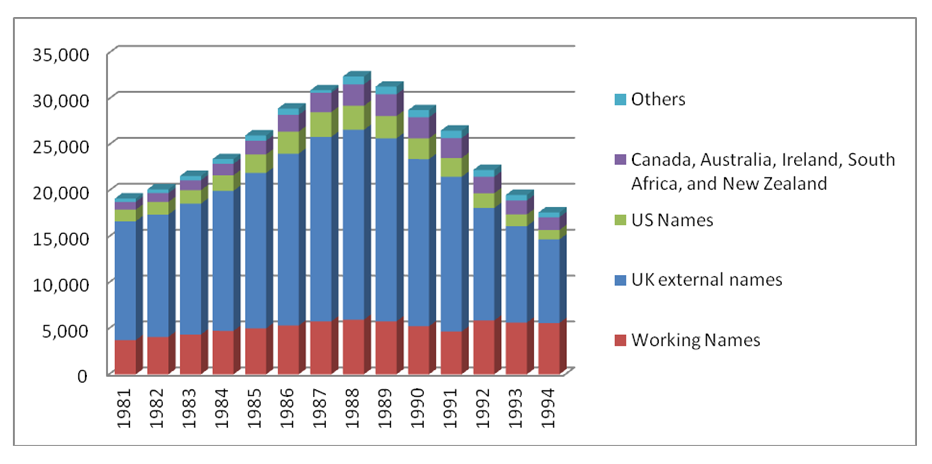

Webnote 1: Composition of Lloyd’s membership 1981-1994 *

Names shown as Working/External, and External Names shown by country

Source: Lloyd’s

The book concentrates on the position of Names in Britain and the US, where the great majority lived and where the main legal issues arose. Many Lloyd’s members in other countries joined British-based action groups and some sought remedies in their own local jurisdictions. It is beyond the scope of the book to attempt to describe these efforts.

Likewise, the book concentrates on Lloyd’s dealings with insurance regulators in Britain and the US, and securities regulators in the US. However, detailed discussions were also needed with both insurance and securities regulators in many other jurisdictions around the world, especially in each main Commonwealth country. These involved London-based market representatives, the staff of the Corporation’s International Department, reporting to Peter Lane, and Lloyd’s many local representatives. Once again, it is regrettably beyond the scope of this book to record all these efforts.

During the fifteen months between the publication of the Reconstruction Plan and its achievement, many meetings were held with overseas Names to explain the Plan, report on progress towards its achievement and to listen to issues of special concern to Names in various locations. Representatives of Lloyd’s, the ALM and others travelled often, none more frequently than Deputy Chairman John Stace, a members’ agent by background and a communicator by temperament.

Webnote 2: Early version (1978) of Lloyd’s verification form *

NAME OF CANDIDATE

To: The Committee of Lloyd’s.

Gentlemen,

With reference to my application to be admitted as an

Underwriting Member of Lloyd’s, I confirm that I understand the

following matters which have been explained to me by my Underwriting

Agent:-

(1)As an Underwriting Member of Lloyd’s my liability

is unlimited.

(2)The control of my underwriting must remain solely

in the hands of my Underwriting Agent.

(3)There will be a continuing minimum requirement

concerning my Means.

(4)Notwithstanding that part of my Premium Limit may

be unallocated, I will be required to provide a

Deposit for the whole of such Limit.

(5)How Syndicate expenses, salaries, personal expenses

and profit commission are calculated and charged.

(6)The rules of the Committee whereby, in the event

of my Premium Limit being exceeded, I may be

required to provide additional funds.

(7)I may inherit liability for claims arising out of

losses which may have occurred prior to my becoming

an Underwriting Member of Lloyd’s.

Further I confirm –

(a)that I have been shown the results of at least

the last seven closed underwriting years

(where applicable) for each of the Syndicates

I propose to join; and

(b)I have seen and understood the Underwriting

Agency Agreement applicable to each of the

Syndicates which I propose to join.

Signature of Candidate

Date ………………………

Webnote 3: Summary of Membership: The Issues, first published in 1987 *

Note: Extracts from the version published in 1987 are shown below. The document was revised later. In particular the complete delegation of members’ affairs to members’ agents was altered from 1990 onwards when they delegated actual underwriting directly to managing agents.

LLOYD’S OF LONDON

KEY MEMBERSHIP ISSUES

Insurance is a risk business: losses as well as profits can be made.

The entire personal wealth of a member is at risk – members must consider whether they can afford to lose what may amount to substantial sums and why they wish to become a member.

Members are required to lodge a deposit with Lloyd’s and prove their wealth (means) periodically. The levels of Lloyd’s deposit and means must be maintained at all times and these levels may be increased by the Council.

Members must delegate complete control of their affairs to a members’ agent and members may take no part in the day-to-day business. Members must choose their members’ agent with great care to ensure that its practices and policies are compatible with the member’s philosophy. Before making their choice, members should consider visiting more than one members’ agent.

Members have no direct control over the premium income accepted on their behalf. If their premium income limit is exceeded, they may be required to provide further security and any losses may be increased.

Membership is personal – it cannot be shared, sold, transferred, assigned or bequeathed.

Members inherit both assets and liabilities in respect of business underwritten before they joined a syndicate. There can be no certainty that the assets will be sufficient to cover the liabilities.

Members (or their estates) will remain liable for losses until their Lloyd’s affairs are wound up, usually taking a minimum of three years.

Past results may be an unreliable guide to future prospects. There is no such thing as a prospective ‘average’ return. High returns are usually accompanied by higher level of risk.

Cash calls may be made at any time from commencement of membership including within the first three years.

Underwriting is a cyclical business and membership should be viewed as a long term venture.

1 MEMBERSHIP

Insurance is a risk business and by its nature is cyclical. Losses as well as profits can be made. Even if the Lloyd’s market makes an overall profit, some individual syndicates may show losses.

Personal unlimited liability is a fundamental aspect of the structure of Lloyd’s. Members (Names) underwrite on a syndicate and on their own account: they are not in partnership and do not have any joint liability with any other members underwriting on

that syndicate. The liability of members to meet any claims arising from their share of the underwriting business extends to each member’s entire personal wealth and is not confined to the security provided

by the member or to the amount of wealth (“means”)

shown nor to individual premium income limits.

Members must appoint a registered members’ agent to act on their behalf, to whom they delegate the complete control of their affairs at Lloyd’s. Members themselves may take no active role in the conduct of the insurance business underwritten on their behalf,

the members’ agent having both the authority and

the obligation to act always in the best interests of the Name. It is necessary for the members’ agent to delegate authority, in particular to delegate underwriting authority to a managing agent.

The respective rights and responsibilities of the Name and the members’ agent are set out in an agency agreement. This agreement is required to be in a standard form and to contain standard clauses.

The selection of a members’ agent by the Name is of primary importance: this is highlighted by the

complete delegation of the management of a

member’s Lloyd’s affairs by the Name to the

members’ agent, thereby placing their entire personal

wealth at risk through that agent.

Membership of Lloyd’s is personal and unique to each member as an individual. It cannot be shared, sold, transferred, assigned or bequeathed as a method of reducing or disposing of the member’s commitment.

Webnote 4: Liability Insurance – uncertainty about the cost of claims *

Estimating the cost of future claims is difficult and inherently imprecise. It is especially hard to judge the amount to be paid by way of a liability claim. This depends on who is held responsible. Sometimes this is obvious, but often it is a matter of negotiation or litigation. Negotiations may be long drawn out. Litigation can take even longer, and may be subject to appeal. The Concorde crash described briefly below and the Exxon Valdez oil spillage mentioned later provide vivid examples.

No-one knows exactly for how much an airline may be held responsible for a plane crash until a settlement is reached. Even then, a court can overturn it. The underwriter has the task of estimating this as best he can. He may already know the number of fatalities and the all-important question of their nationality. (It is a harsh feature of the world that compensation due for Americans is usually greater than for Europeans, and much greater than for Africans. It can also be greater if passengers are aware of their fate for several minutes, rather than a few seconds.) The underwriter makes a provision for known incidents, like a crash, and a further provision for possible claims, that have not yet been notified. These are referred to as ‘incurred but not reported’ (IBNR). The cumulative provision he makes for all possible outstanding claims – known and unknown – is called the syndicate’s reserve.

If the aeroplane in which you are travelling crashes and kills you, the airline will owe your family some compensation. But how much? And who was really responsible – the airline or the maker of the aircraft? Or perhaps the engine manufacturer? Or the airport, or maybe a terrorist ? After the fatal Air France Concorde crash of July 2000, blame was shared among many parties, including the last plane to use the runway – operated by Continental Airlines – because one of its aircraft dropped a piece of metal that set in train a series of events, including a tyre blowout on the Concorde that damaged one of its fuel tanks. The insurers of many parties had to negotiate about how to share the liabilities, that is for how much the action (or inaction) of each party may have caused the accident to happen. A full ten years later, a Parisian court found Continental Airlines criminally responsible for the disaster. The court also ruled that Continental should pay 70% of compensation claims: Air France (and its insurers) had already paid €100 million to the families of the victims. Two years later, a French appeals court overturned the criminal verdict.

There is much more material available on the internet about rival theories about contributory causes to this single accident. It struck what had been, up to then, the safest ever commercial aircraft, with 27 years of fatality-free operation. The purpose of citing it here is simply to demonstrate the complexity and uncertainty that can surround a liability claim.

The liabilities due to be paid by a reinsurer can be even more complicated and hard to predict. The general principle is that the reinsurer ‘follows the fortunes’ of the primary insurer to which he has provided cover, in the way agreed in the contract between them. But disputes between insurers and reinsurers can occur, for example over whether the former have, in fact, paid out only the amount they are strictly obliged to pay, and not come to an over-generous agreement. This is sometimes suspected, as the primary insurer may feel under pressure to preserve relationships and keep the primary business. This can make accurate reserving by reinsurers even more hazardous.

The Exxon Valdez oil spillage provides another striking example of how the impact of liabilities can be hard to predict and can change in the light of court decisions. See Webnote 17.

Webnote 5: Evolution of Lloyd’s Governance *

This is a longer version of Appendix 3 in the book.

A complex market and society like Lloyd’s had to evolve some form of governance. The first steps towards a constitution were taken in 1771. A group of underwriters had broken away and established a new Lloyd’s in Popes Head Alley, wishing to draw a clear line between their underwriting activities and the gambling that had become endemic among others. Now they formed a Committee. An energetic young immigrant, born in St Petersburg into a family of German merchants, found new premises for this group at the Royal Exchange. His Name was John Julius Angerstein. Policies signed by this emerging leader were known as ‘Julians’ and were very well regarded. Before long, he became Chairman of Lloyd’s.

Lloyd’s first constitution was the 1811 Trust Deed which bound all subscribers to keeping to the rules made by the Committee. To protect Lloyd’s collective reputation, it moved to keep out fraudsters and insist on the solvency of those who joined. The powers of the Committee were strengthened by the Lloyd’s Act of 1871. This also made it a criminal offence for any non-member to sign a Lloyd’s policy. Syndicates began to be formed soon afterwards, equipping underwriters with enough capacity to compete with insurance companies. Early syndicates comprised only a handful of backers: a dozen was considered large.

The part-time nature of the role of Chairman of Lloyds in the 19th century is illustrated by George Goschen, chairman for eighteen years (1869-86,) who combined the role with being an MP and a member of Gladstone’s cabinet as first Lord of the Admiralty. Later he became Salisbury’s Chancellor of the Exchequer. In the last few decades of the century, the figure of Henry Hozier became dominant at Lloyd’s, not as Chairman, but as Secretary. He was autocratic but effective. When he left in 1906 he was a national figure. He became the father-in-law of Winston Churchill who married his daughter, Clementine.

In 1908, after a fierce debate within the Committee, the principle of an audit of each underwriting account was established. At the time, some members thought this was a sensible step to protect the security of the Lloyd’s policy; others thought it an unreasonable invasion of their privacy. An editorial in The Times was one of several decisive influences on the course of the debate. In 1923, Arthur Sturge, the Chairman, called all working Members together. To preserve Lloyd’s reputation, he said everyone should contribute to meeting the losses incurred by an underwriter called Harrison. The motion was carried unanimously. This was done to protect policyholders; the amounts involved were quite small. Soon after that, in 1927, a central fund was set up to protect policyholders in future. Lloyd’s recognised that its reputation required it to be able to make good any deficiencies arising from rare events, like the bankruptcy of a Name. For many years the size of the central fund was a closely guarded secret.

The measures that followed the Cromer report in 1969 were effective in restoring growth in capacity. Lord Cromer’s experience as a Barings banker and as Governor of the Bank of England had been of great value to his working party. He also had extensive contacts in the US, becoming British ambassador to Washington in 1970. He was described as a shrewd man of affairs who applied his mind assiduously to sifting out the essential points in the mass of evidence which his group received. Although the Committee of Lloyd’s accepted many of his proposals, it fatefully decided not to publish his report in full. The chapter on the organisation of syndicates was sensitive and action on it was deferred. It contained many ideas which might have averted some of the problems to come.

Throughout the 1970s membership increased steadily, fuelled by the gearing on non-earning assets and tax advantages. As the proportion of external Names increased, so did the risk that someone would abuse the heavy weight of accumulated trust implicit in a market using other people’s capital on a much bigger scale than before. Several incidents in the late 70s involved a breach of trust. There was the long running Savonita saga, involving a false insurance claim for fire-damaged cars that were spotted driving around Italy unscathed. There was the case of Tim Sasse, who, among other things, allowed American fraudsters to incur huge liabilities for his Names, without proper controls, then tried to cover up his mistakes. There were other cases where the Committee found its powers inadequate to the task of imposing effective market discipline. Certain colourful characters seemed intent on testing and flouting the rules.

These incidents led the committee to appoint a working party under the chairmanship of Sir Henry Fisher to consider the whole system of regulation at Lloyd’s. Fisher recommended a new Act of Parliament to give the Lloyd’s authorities much more supervising clout.

Fisher also recommended that the constitution should better reflect the now much larger constituency of external Names. Names representation on the Council, said Fisher, would assure them that their interests would be properly looked after. The Committee of Lloyd’s accepted the report and sought approval from the membership as a whole to petition Parliament for a private Bill to create a new Council with much more extensive powers to run the Society. This needed to be based upon a two thirds majority of members. The formal ‘Wharncliffe’ meeting was held in the Royal Albert Hall in November 1980, attended by 3,772 Lloyd’s members. Including proxy votes, the bill was supported overwhelmingly by 13,219 members with only 57 voting against it.

Fisher also saw a risk of a conflict of interest in brokers owning managing agents and recommended the brokers should sell them off. This was very controversial; it impacted many business interests. Fisher had looked at this as a lawyer, arguing that there was an inherent conflict of interest in brokers owning the organizations with which they placed their clients’ risks. For example, they might pressurise the underwriter to accept business on terms that were against his better judgment, or give bigger commissions or settle claims too generously. They might also direct business to their associates, on terms favourable to underwriters, thereby short-changing their clients. Competition in the marketplace could be distorted in other ways. Other fears were also expressed. By majority, they came down in favour of compulsory ‘divestment’ by brokers of managing agents, to be carefully implemented over a five year period. Argument raged for some time over whether these were real or imaginary dangers.

It was strongly argued by dissenters that all real dangers could be avoided by means less clumsy than a statutory ban on ownership connections. There could instead be a set of rules to manage the potential conflicts of interest. A number of Lloyd’s people – many brokers, Robert Hiscox, Bryan Kellet and others – made strenuous efforts to persuade the British Parliament that this was a sledgehammer to crack a nut, and would have many adverse consequences. But Parliament insisted on it. Arguably, the ensuing sale of many businesses – with all its attendant jostling for position and opportunity for gain – was a major distraction from more fundamental problems at Lloyd’s. It meant that many syndicates were run by fresh and sometimes weak and inexperienced management.

It is ironic that in investment markets only four years later, British laws on financial regulation moved in the opposite direction: they abolished the historic ‘single capacity’ in favour of permitting dual capacity – jobbing and broking – by the same firm. This was part of a series of changes known as ‘big bang’. In essence, they deregulated the City, throwing its doors open to new competition from abroad, notably US banks. Within a very short space of time, City practices and institutions were transformed.

The Parliamentary Committee also debated about whether managing agents should be permitted to own members’ agents. A few people argued for requiring all members’ agents to be independent, with their own interests completely aligned with those of their members. Shorthand terms were developed for these two concepts: ‘divestment’ meant complete separation of ownership between brokers and managing agents; ‘divorce’ meant complete separation between managing and members’ agents.

The debate on each issue was conducted within Parliament’s rather strange procedures for private bills. The politicians were motivated by arguments of principle, mixed with a little political prejudice. Four of them, chaired by a Labour MP, Michael Meacher, previously a college lecturer, formed the committee that gave the Bill detailed scrutiny and heard representations. Some of the Lloyd’s characters who appeared before it were defending or advancing obvious vested interests. When the Bill returned to the floor of the House, sixty-odd Conservative MPs were precluded from voting by their Lloyd’s membership; Labour MPs were largely supportive of their colleague Meacher; the main opposition came from some of the uninvolved Conservatives who were not always well informed.

After the hearings, the Parliamentary committee wanted both divestment and divorce. This meant going back to the membership to vote on their wishes on both matters, and a special byelaw to permit postal voting. Members voted by very substantial majorities in support of the Chairman’s recommendations, which were explicit on divestment (in favour) and implicit on divorce (against.) The upshot was that divestment was required by the Act, whereas divorce was not. Several years later, Lloyd’s CEO, Ian Hay Davison, said that Parliament had ‘shot the wrong horse.’ Instead, it should have required divorce, which he came to regard as much more important in the cause of advancing the interests of external Names. Sir Peter Green, who, as Chairman, led Lloyd’s approach to Parliament, came to the same conclusion years later.

The intense debate about the provisions in the Lloyd’s Act is fully reported in Godfrey Hodgson’s Lloyd’s of London: A Reputation at Risk, first published in 1984. While the main purpose of the Bill was to give Lloyd’s a new constitution and a much stronger ability to regulate the market, it also conferred on the Society immunity from suit by its members. This immunity was controversial. It was argued to be essential for strong self-regulation. The Chairman told his team that without immunity, he thought the Bill should be dropped.

Meacher accepted the case for immunity and was supported in the House of Commons. In a House of Lords debate, two members who had suffered from the Sasse debacle, argued strongly that the Lloyd’s Council should not need immunity and should have no fear of the courts. Lord Mishcon, himself a successful commercial solicitor, acknowledged that it was “very innovatory” to grant immunity from suit to anyone or any institution. But he went on to say that it was a ‘question of balance’ and that Lloyd’s should not be put in a position where its resolve could be weakened by the threat of litigation. Parliament granted the newly reformed Society of Lloyd’s the privilege of immunity from civil suit. The 1982 Lloyd’s Act received Royal Assent in the summer.

The ink was barely dry on the new Lloyd’s Act when a fresh scandal emerged. An American broker had bought a British broker and set about performing due diligence to American standards. This process led to the discovery that a major fraud had been committed, involving theft of syndicate money by Peter Dixon and Peter Cameron Webb, later referred to as the PCW scandal. Meacher and other MPs said afterwards that if this scandal had broken sooner, the Lloyd’s Act would not have passed in anything like the form it did.

This provided a serious challenge to the Chairman and Committee of Lloyd’s: they were not yet equipped with the new powers that would become effective on January 1, 1983. It also left a bitter taste in the mouth of Parliament. The leader of the opposition called for the government to ‘take direct powers of supervision over Lloyd’s.’ It was then that the Governor of the Bank of England, Gordon Richardson, persuaded the Lloyd’s Chairman to accept the appointment of Ian Hay Davison as Lloyd’s Chief Executive and Deputy Chairman, a new position.

During the next few years, the new Council set about the process of reform with vigour, urged on by the new Chief Executive. The Council met several days a week, spawned a large number of working parties, and introduced many new byelaws and a new system of discipline. Despite these efforts, in 1985 when the government decided to introduce a Financial Services Bill to reform the operation of the investment market, there were many calls for its scope to be extended to cover Lloyd’s as well. It was argued that Names endured similar risks to those of investors and required similar protection. Lloyd’s argued that the new Council was working well and getting on with the necessary reforms, and should be left alone.

To resolve this question, the government appointed a committee of enquiry, headed by Sir Patrick Neill. In 1986, Anthony Haynes, the ALM Chairman, wrote to Paul Channon, the Secretary of State for Trade and Industry, on behalf of his 3,500 members. He pointed out that his was the only body whose sole purpose was to concern itself with the interests of Lloyd’s members. He welcomed the appointment of the Neill enquiry; the ALM would provide it with a more detailed submission. He also said “however, there is one issue on which we should like to state our views immediately: this is whether or not Lloyd’s should be included in the Financial Services Bill.” He said that the ALM was convinced that it would not be appropriate, nor in the interests of its members for Lloyd’s to be included. It would make the system of regulation more complicated and cumbersome and have the practical effect of slowing down rather than speeding up reform. He also thought it would deter people of the calibre needed from serving on the Council itself.

After taking extensive evidence from all parties, the Neill Committee came down in favour of Lloyd’s continuing to be responsible for supervising its own marketplace. But it set out an ongoing obligation to achieve a level of protection for its Names that was equivalent to the new investor protection regime elsewhere. For good measure, it made 70 recommendations for further reform, while at the same time commenting favourably on the Council’s ‘reforming zeal’, with a phrase that was music to Lloyd’s ears: ‘we know of no profession or equivalent body which has accomplished such a major programme of reform in such a short timescale.’

Lloyd’s heaved a collective sigh of relief at this conclusion. No-one would have welcomed a return to an intense argument in Parliament about the future arrangements at Lloyd’s. The last experience had proved harrowing: the fate of many businesses rested on the outcome of a debate that was at times comic, often ill-informed and in places grotesquely self-interested. In reaching its conclusions, the Neill committee had seen the need to balance two prime purposes in regulation at Lloyd’s: the protection of the policyholder, for whom the resources to meet valid claims must always be forthcoming; and the protection of members. To find the right balance in a dynamic marketplace was a challenging task, best left to Lloyd’s own Council.

Inevitably, the report and its main conclusion was denounced as a whitewash by those who were convinced that past scandals showed Lloyd’s to be a den of thieves. In a report entitled “Neill lets Lloyd’s off the hook” the Economist said Neill had sidestepped some of the biggest issues he was asked to address: while some of his recommendations were for sensible and much needed reforms, he made a powerful case against the self regulation that he did not seek to change.

There is no doubting the hard work of the new Council in developing a new system of regulation and discipline in the years that followed the new Act. However, the Council chose to delegate the day to day supervision of the market to the Committee of Lloyd’s – the term still given to a body comprising only the elected working members. The Council gradually shifted to a pattern of monthly meetings, but the Committee met weekly. Matters affecting the market were brought first to the Committee, and only later, if at all, to the full Council. New byelaws required the support of a majority of both the working members and the external and nominated members of Council, taken together.

Appendix 3 of the book describes Neill’s recommendations for changing the composition of the Council, which were immediately accepted by Lloyd’s.

Webnote 6: Lloyd’s architects *

Lloyd’s new building became a symbol of the institution during the crisis years. Some people love it; some hate it. Its creation was against the odds; it reflects the supreme self-confidence of the Society at the time it was commissioned. It still impresses clients and capital providers who visit it daily from all parts of the world. In 1986 it was very striking; later it became the focus of much wrath.

How did this conservative institution end up with the ultimate expression of modernism? Lloyd’s was housed in the Royal Exchange until the 1920s when it outgrew these premises. A site was acquired in Leadenhall Street and Sir Edwin Cooper, a favourite architect among city institutions, was commissioned to design the new building. It had a triumphal arch and a large 16,000 ft.² room for underwriting business. Completed in 1928, it too was soon inadequate in size. During the Second World War, the Cooper building was untouched by the German bombs that flattened the site just across Lime Street. Foreseeing the need for expansion, Lloyd’s bought this land in 1950. The architect for what was to become the 1958 building was Terence Heysham, Cooper’s former assistant. Kenneth Powell, an architectural correspondent, described his design as “a suave but rather bland exercise in prescription classicism, a comfortable rather than a challenging building.” Most underwriters liked it. As Lloyd’s grew, it became clear that this was also too small.

In early 1977, Lloyd’s began looking for an architect but had not yet decided what he or she would be asked to do. Could the 1928 building be remodelled? Or was a new building the only answer? Gordon Graham, recently elected as president of the Royal Institute of British Architects took an interest. He was keen to see some of Britain’s brightest young practices get work. He went to see Ian Findlay, the Lloyd’s Deputy Chairman responsible for property, and advised him that Lloyd’s should not look for a scheme but a strategy. One priority was keeping Lloyd’s in operation during the rebuilding process. “I told Lloyd’s to find an architect and work with them on a development strategy before even thinking about designs” said Graham.

A dozen architects were asked to submit examples of their work. Six were then selected to work up their ideas. At Graham’s suggestion, the last six included Richard Rogers. He was still formally in partnership with Renzo Piano, with whom he won the Pompidou Centre competition in 1971. Rogers now found himself with little work. He brought two of his strong team – John Young and Marco Goldschmied – into partnership in 1977, retaining the title of Piano and Rogers. Rogers won the competition by responding well to Gordon Graham’s formula – strategy first, scheme second. Lloyd’s explained that above all it wanted flexibility, with scope for the market to grow or contract. This predisposed Lloyd’s to accept a radically modern building. The first step was to find out more about how Lloyd’s worked. Goldschmied spent many days at Lloyd’s, observing. He liked the atmosphere he found there.

The immediate need for underwriting space had become desperate. Rogers and his team adapted the 1958 building to serve for a further six years: Portacabins were added to the roof and an extra basement area – nicknamed the Yellow Submarine – was added for more underwriting space. Meanwhile, the new building was designed and constructed on the other side of Lime Street. It was to incorporate the American architect Lewis Kahn’s notion of ‘served’ and ‘servant’ spaces – with the services concentrated in towers surrounding the main uncluttered space. Khan’s own inspiration for this was Frank Lloyd Wright’s 1904 Larkin building at Buffalo New York, with its great central top-lit workspace, surrounded by galleries.

The City Council agreed to the demolition of the recently-listed 1928 Cooper building. Conservationists were placated by retaining the grand arched portal; some pieces, including the Lutine Bell, would be transplanted. The concept was a building with a high degree of flexibility to respond to future needs. In June 1979, Lloyd’s redevelopment committee, chaired by Sir Peter Green, enthusiastically endorsed Rogers’ outline proposals, for a central glazed atrium surrounded by galleries. Prominent concrete columns, both on the outside and within the atrium would stand out. “The service towers, would be the visual expression of the Khanian doctrine of served and servant spaces.” says Powell.

Courtenay Blackmore was the Corporation executive closely involved in every important decision. Green’s own involvement was close. “It was an exceptional client/architect relationship” recalled Rogers. A key part of the design strategy was that Lloyd’s should be, like the Pompidou Centre, a place of movement. Exposing the mechanism of the escalators behind clear glass panels was intended to celebrate movement, as were the glass lifts.

Although the architects and the redevelopment committee wanted to impose standard boxes; underwriters wanted variety. The chief points of friction were on interior design. According to Powell, “the crisis came with the two executive floors at the top of the building containing the committee room and the offices of the Chairman and other senior officials. ” Rogers’ interior designer, Eva Jirinca, proposed very modern offices. But the chairmanship had passed to Peter Miller who did not share the enthusiasm of his predecessor for the building, or for modern design generally. His wife was an interior designer with equally strong views. Gordon Graham, who maintained an informal interest in the project, tried hard to dissuade Lloyd’s from changing direction but failed. The Paris decorator, Jacques Grange, was appointed by Lloyd’s to fit out the executive floors in a semi-traditional manner with lots of marble and heavy reproduction furniture. Powell said “The effect of these two floors is like a bad dream – it seems out of place and incongruous. Surely this can’t really be happening in a Richard Rogers building?”

The last two years of the project saw growing resistance to Rogers’ ideas on the interior. As soon as it began to take shape, a debate intensified among Lloyd’s members about the merits of the building. As it began to collect the first of a long series of design awards, there were growing complaints that it was the wrong building at the wrong price. In the nine years which elapsed between Lloyd’s initial decision to commission a new building and its opening, the climate of opinion in Britain changed. There was a counter-attack on innovative design in the City.

Few occupants would agree with Powell, a huge fan, who says “Described by one observer as a ‘mechanical cathedral’ its 300 foot silver and glass structure makes a startling impact in its context of city office blocks and epitomises Richard Rogers concern with total flexibility and technological advance. Like a mediaeval cathedral, Lloyd’s is detailed beautifully, even in those places which the eye cannot see. Against all the odds, Rogers and his team gave conservative London a building which expresses the heroic age of modernism, a benchmark for everything built or proposed in the capital in the years that followed. Lloyd’s is a real London building, big and monumental, yet full of the incident and variety which allow it to sit next to the Victorian market, in a street plan which dates back to the days of Chaucer. To come across it suddenly and to comprehend the strength and conviction, the determination and the single-mindedness which made it, is an extraordinary experience. London may not see its like again.”

Underwriters disagreed. Many saw the building as dysfunctional. One problem was the slowness of the lifts. The wait at each of several floors could seem interminable. The isolation of the leadership – now known as ‘the twelfth floor’ – from the day-to-day market was further reinforced. Reserving one lift for direct travel to the top floor caused great resentment, and was eventually dropped. Instead, to save the Chairman’s time, a waiter would accompany him and turn a key to prevent the lift stopping on floors other than his destination. This too was unpopular. Before long the market associations organised a letter to the chairman asking if they could all return to the 1958 building. This attitude was not a complete surprise: Lloyd’s underwriters had disliked their new home nearly every other time they had moved. As it was clearly impractical to abandon the new building, studies were undertaken in an effort to improve matters. Meanwhile, much more serious issues were festering beneath the surface.